sacramento property tax rate 2021

Sacramento county tax rate area reference by primary tax rate area. The California sales tax rate is currently.

Why Now Is The Best Time To Refinance Your Home Real Estate Tips Real Estate Advice Mortgage Tips

This tax has existed since 1978.

. The California state sales tax rate is currently 6. 2017-18 2018-19 2019-20 2020-21 2021-22 CCPI Change 2619 2962 3847 2980 1036 Base Year Value Change 104 Factor 102 102 102 102 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. Tax Collection and Licensing.

Two Family - 2 Single Family Units. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918.

Total tax rate Property tax. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The property tax rate in the county is 078.

Sacramento county collects on average 068 of a propertys assessed fair market value as property tax. This is the total of state and county sales tax rates. Permits and Taxes facilitates the collection of this fee.

Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. Start filing your tax return now. TAX DAY NOW MAY 17th - There are -361 days left until taxes are due.

Ad Find Out the Market Value of Any Property and Past Sale Prices. 025 to county transportation funds. 3636 American River Drive Suite 200 M ap.

These entities are legal governmental units regulated by officials either appointed or elected. The Sacramento County sales tax rate is 025. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

The median property tax on a 32420000 house is 239908 in California. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Median Property Tax Rates By State Ranked highest to lowest by median property tax as percentage of home value 1 1 New Jersey 189 2 New Hampshire 186 3 Texas 181 4.

075 to city or county operations. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Under New Mexico law the government of Sacramento public colleges and thousands of other special districts are given authority to evaluate real estate market value set tax rates and levy the tax.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Property information and maps are available for review using the Parcel Viewer Application. The median property tax on a 32420000 house is 220456 in Sacramento County.

Did South Dakota v. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

Two Family - 2 Single Family Units. The Sacramento sales tax rate is. They can be reached Monday - Thursday 830 am.

This is the total of state county and city sales tax rates. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. Revenue and Taxation Code Section 72031 Operative 7104 Total.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29. For more information view the Parcel Viewer page. Real Estate Tax Rate.

Here is a list of states in order of lowest ranking property tax to highest. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. Two Family - 2 Single Family Units.

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento county tax rate area reference by taxing entity.

Two Family - 2 Single Family Units. The minimum combined 2022 sales tax rate for Sacramento California is. This is the total of state county and city sales tax rates.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

View the E-Prop-Tax page for more information. The minimum combined 2022 sales tax rate for Sacramento County California is 775. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

Two Family - 2 Single Family Units. The documentary transfer tax is computed with the value of the interest or property conveyed exclusive of the value of any lien or encumbrance remaining thereon at the time of sale exceeds one hundred dollars 100 at the rate of fifty-five cents 055 for each five hundred dollars 500. The median property tax on a 32420000 house is 340410 in the United States.

The 2018 United States Supreme Court decision in South Dakota v. Total Statewide Base Sales and. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

The County sales tax rate is.

Sacramento County Ca Property Tax Search And Records Propertyshark

Cryptocurrency Taxes What To Know For 2021 Money

Secured Property Taxes Treasurer Tax Collector

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Riverside County Ca Property Tax Calculator Smartasset

Up To Date Photos Maps Schools Neighborhood Info First Time Home Buyers Elk Grove Real Estate

Pin On Personal Finance Infographics

Property Tax California H R Block

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento County Ca Property Tax Search And Records Propertyshark

Secured Property Taxes Treasurer Tax Collector

Davlyn Investments Acquires Terraces At Highland Reserve Apartment Complex Near Sacramento For 95m Rebusi Sacramento Apartments Terrace Roseville California

Car Insurance Group Nissan X Trail 2021 Group Insurance Car Insurance Nissan

Property Tax In San Diego The Rate When It S Late And Much More

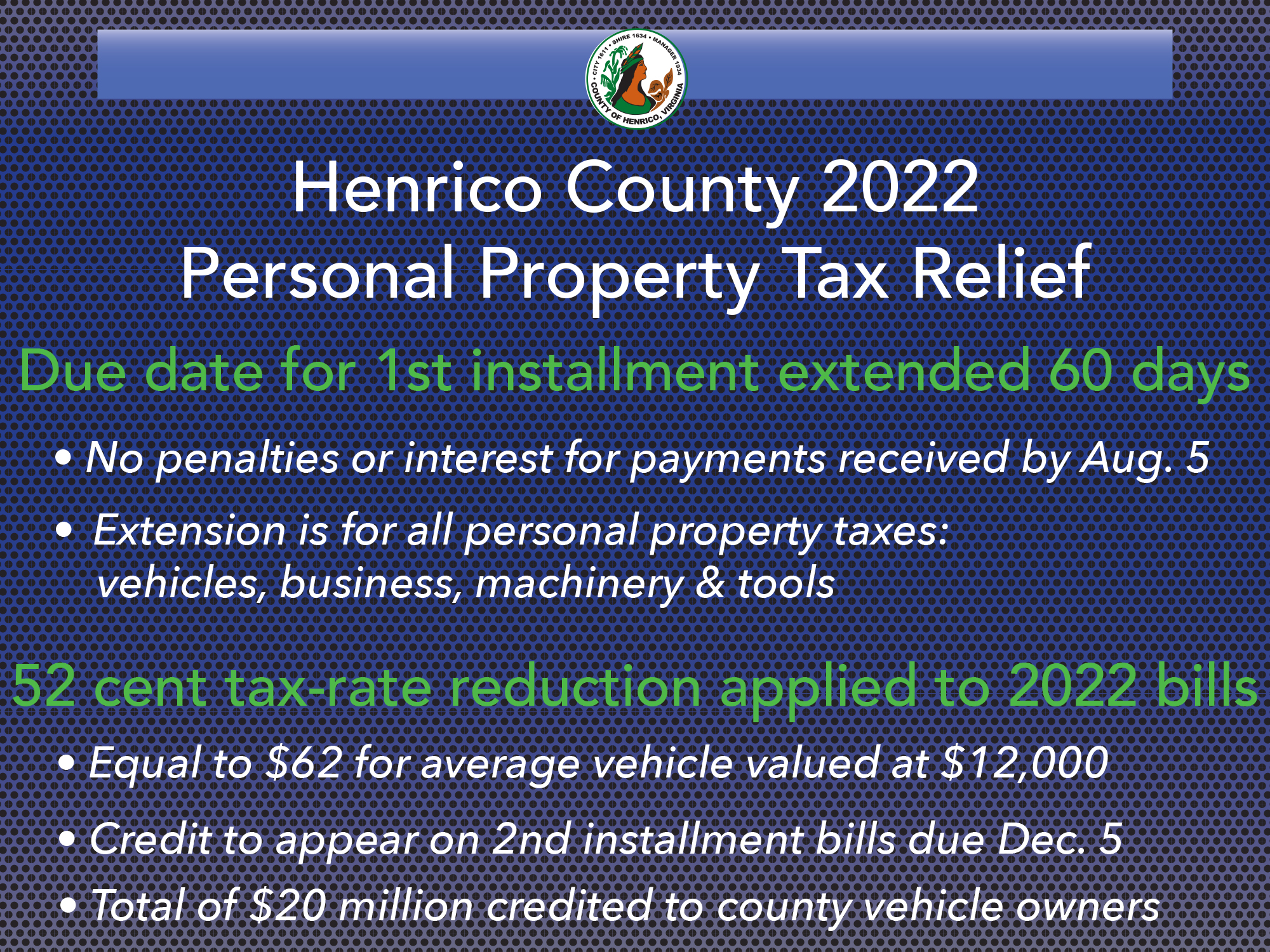

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Sacramento County Ca Property Tax Search And Records Propertyshark